More customers, less admin

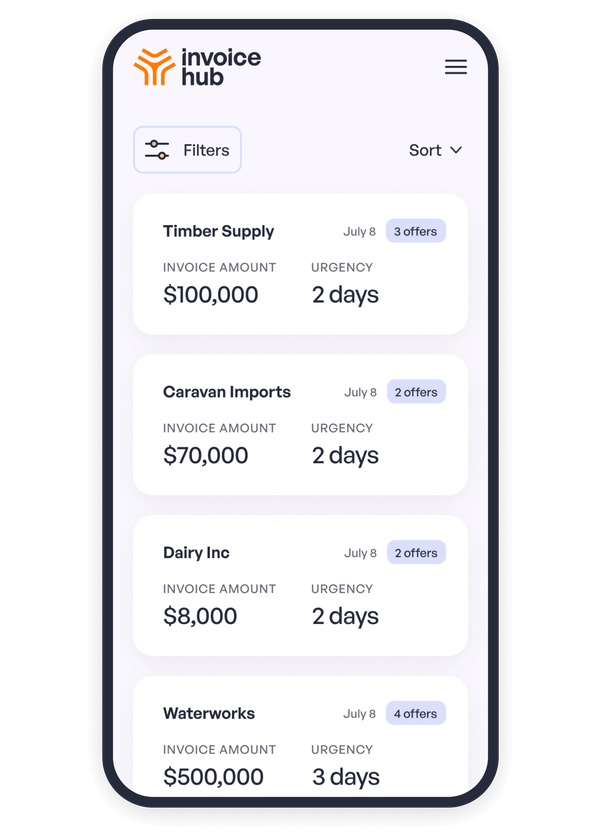

Browse opportunities to invest in pre-vetted businesses. Save time and marketing effort by connecting with new customers through our hub.

Reliable lending opportunities

Invoice Hub is where small and medium-sized businesses look for loans against their sent invoices. Businesses provide balance sheet and profit and loss information, and undergo an anti-money laundering check. They also answer questions about the payment history of customers whose invoices are uploaded, and how long they have been doing business together. All you need to do is choose which invoices to make an offer on.

On your terms

Review the financial statements and payment history information provided. Then set the interest rate, expiry, and repayment terms for any offers you make. Invoice Hub is not a payment platform. When a business selects your offer, you conduct any additional checks, finalise terms and manage payment. Lenders only pay to use Invoice Hub when a loan is confirmed. Invoice Hub charges 1% of the loan amount, which is added to what the customer repays.

How it works

Review invoice

See the invoiced amount, payment due date, and information about the invoiced customer’s payment history.

Make an offer

Enter the amount you offer to lend against the invoice, interest rate, expiry, due date, and settlement date.

Contact the borrower

If your offer is selected, contact the business to agree on terms.

Finalise terms

Approve and pay out the loan.

Fair, transparent pricing

Browse lending opportunities for free, and only pay if a loan is confirmed. Invoice Hub charges 1% of the loan amount. The borrowing business pays this fee to their lender on top of the agreed loan amount, and the lender pays it to Invoice Hub.